At some point in time, either for your business or personal income taxes, you’ve probably needed to pay business taxes to the Canada Revenue Agency (CRA).

On May 30th, 2023 our Lady in Charge Teya Jensen had a moment of panic when she noticed her personal bank Royal Bank of Canada (RBC), Canada’s largest banking institution, removed its option to make payments to the CRA using Interac Online Payments. She immediately thought “Gasp! Will RBC customers have to physically visit the bank and stand in line to pay the CRA?” Thankfully, after a quick bit of research, she discovered the world wasn’t ending and that several options to pay the CRA online still exist.

Here are Homeroom’s super helpful, step-by-step instructional videos to show you how to pay the CRA online:

How to pay for your GST return online:

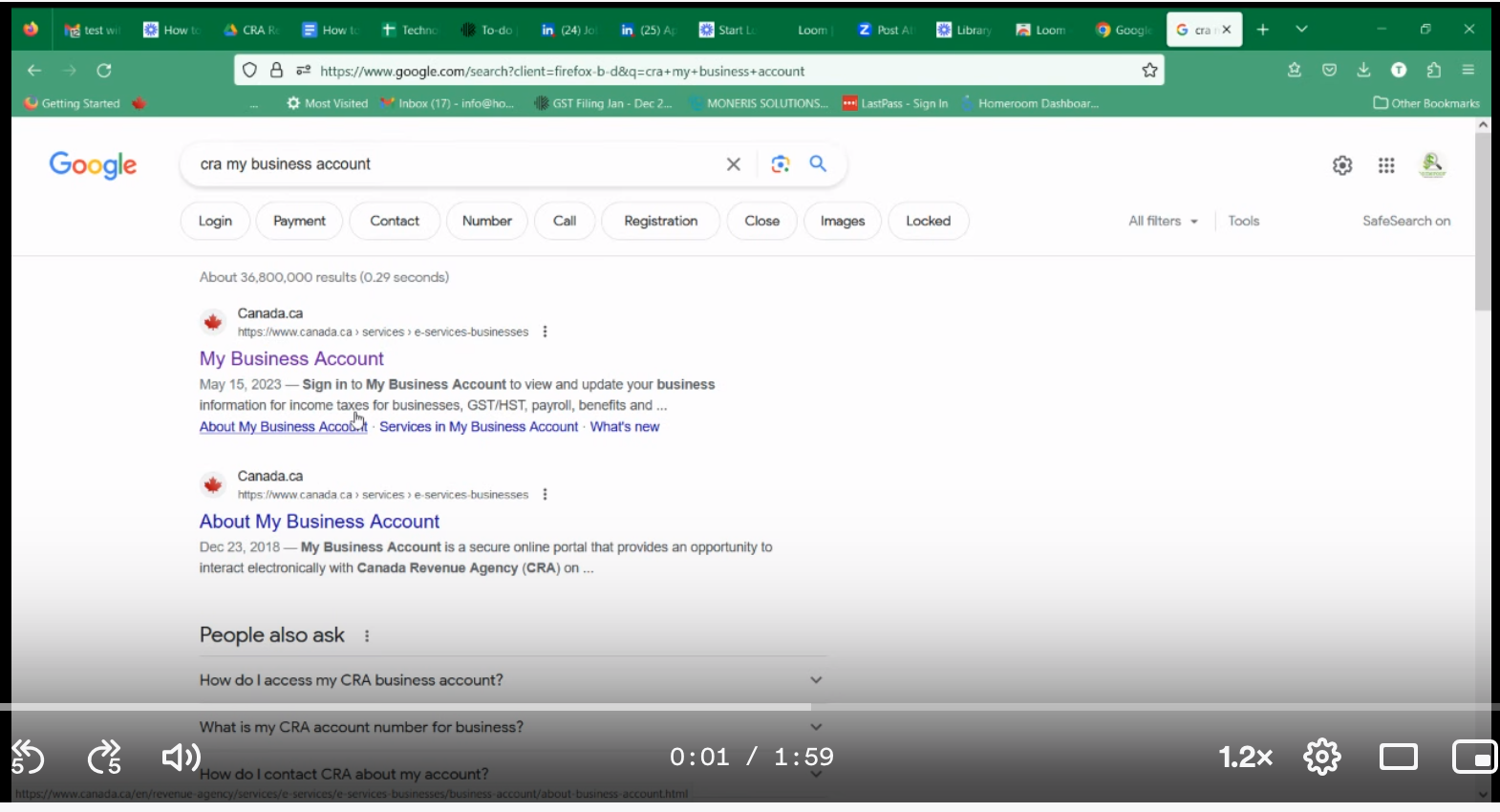

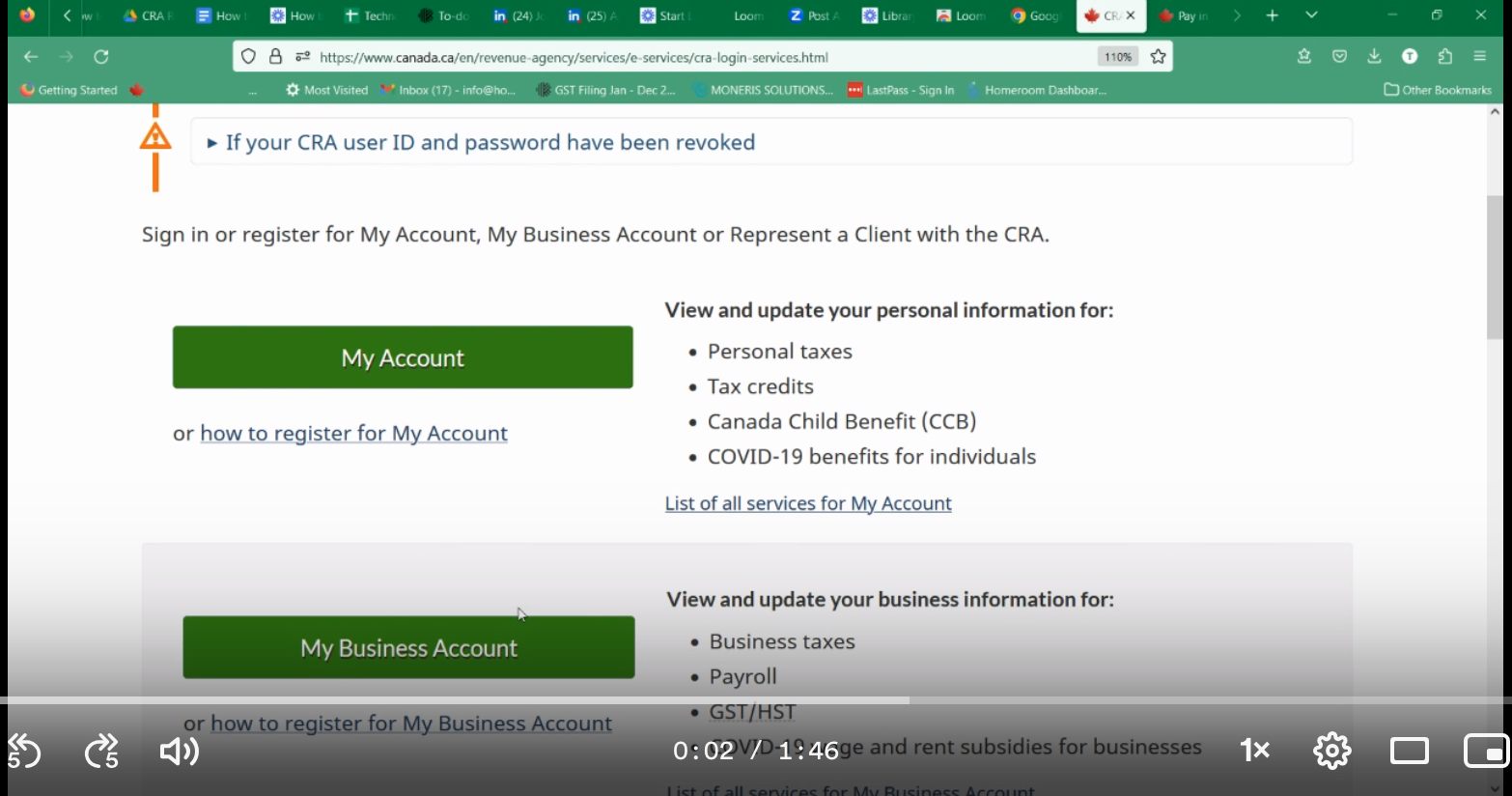

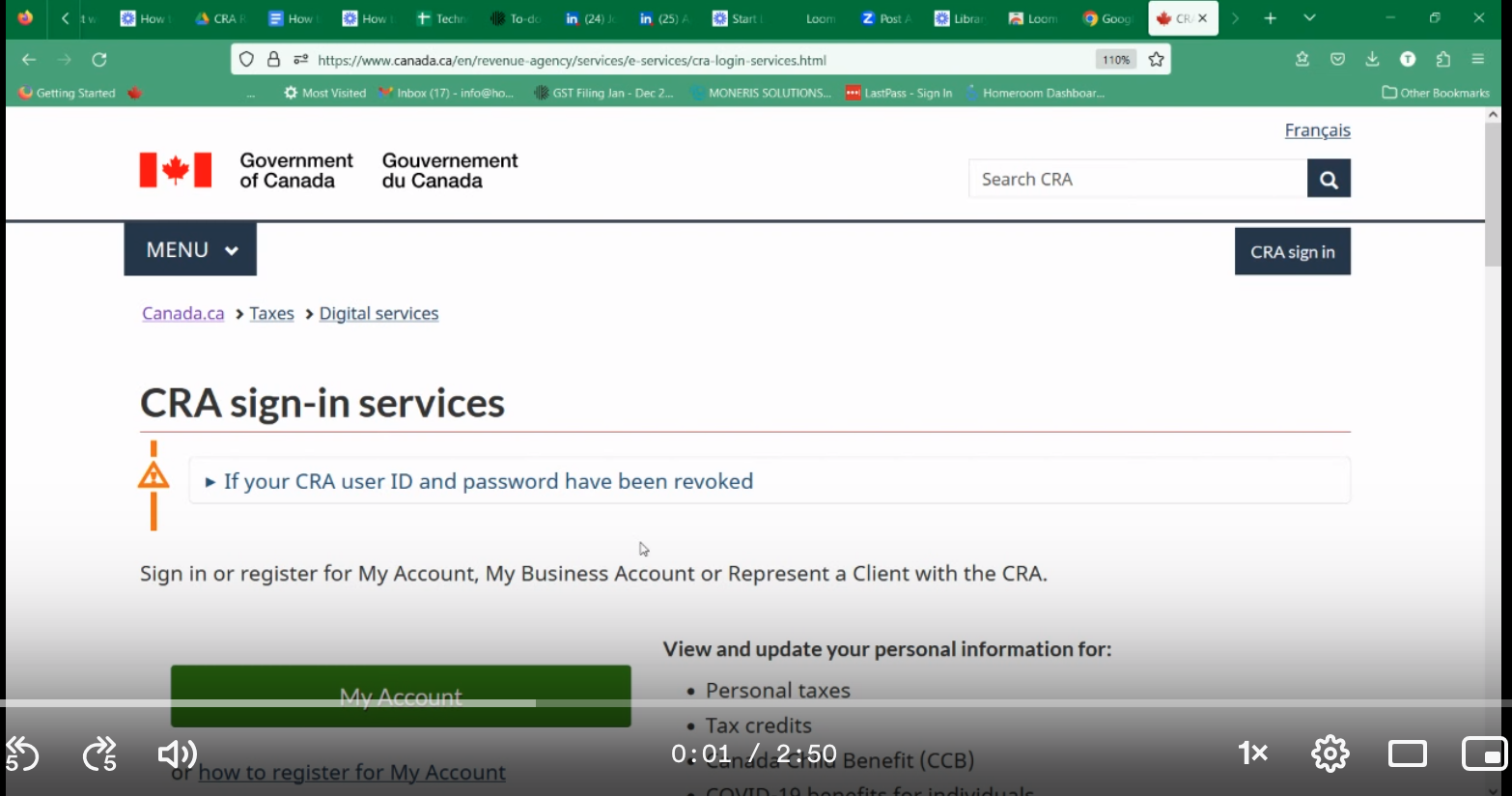

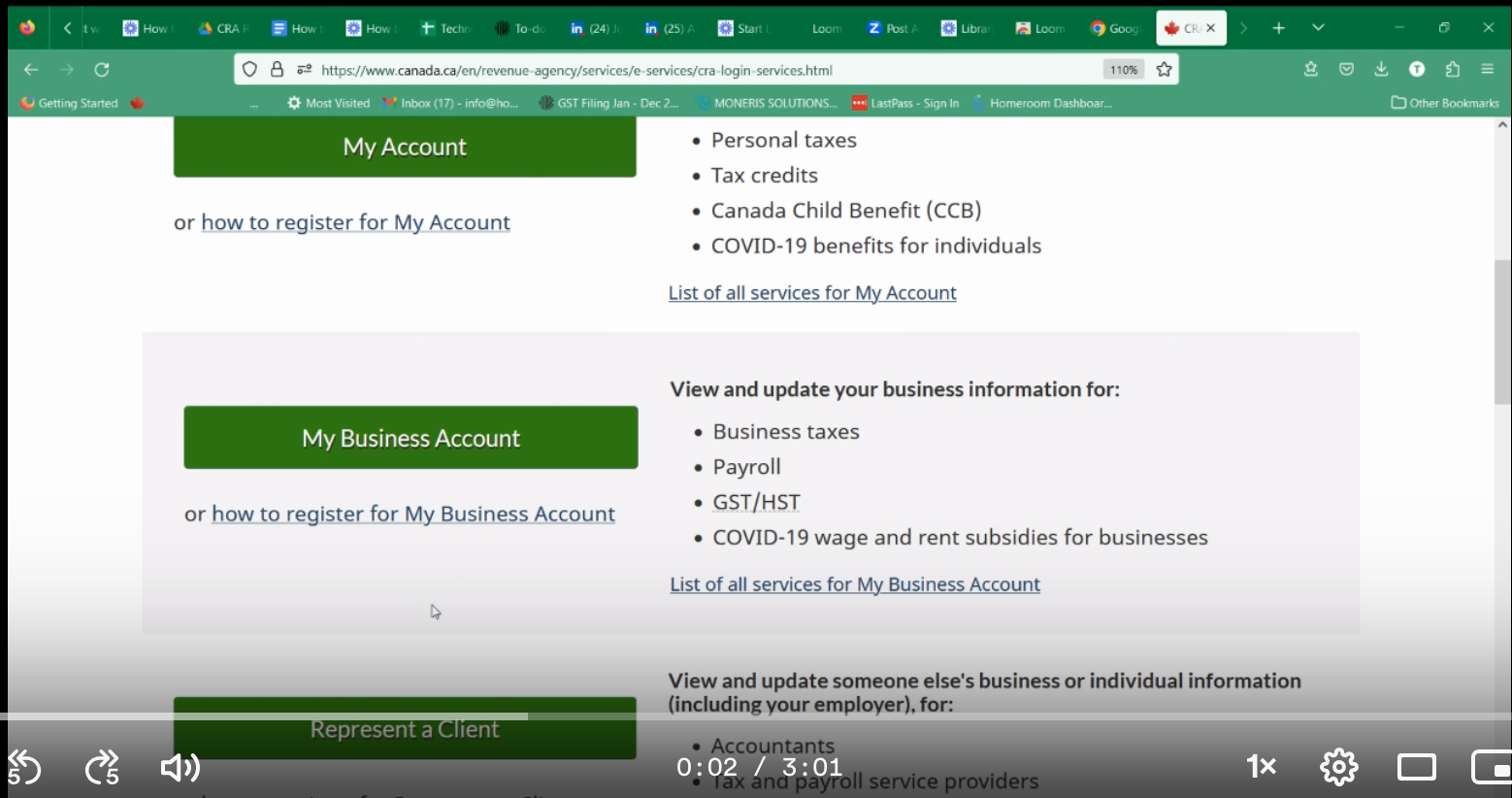

First, you’ll need to Google my business account for CRA and sign in. Then, click on GST and your RT0001 and select “view and pay account balance.” If you have a current GST return to pay, it will show you the amount here. Let’s pretend we’re paying for our June return. Enter the amount and click “proceed to pay.” You’ll have three payment options, but the first one doesn’t work with RBC anymore. Instead, you can schedule one or more payments and enter the amount.

Generate a QR Code and pay at Canada Post:

First, you’ll need to log in to your CRA account and navigate to the GST section. From there, you can view and pay your account balance. In this example, I don’t have a return to pay, but let’s pretend we’re paying for our June GST return. If you had a return, you would enter the amount owed and generate a QR code to take to Canada Post for payment with your debit card. This replaces the need for the remittance form that you need if you want to pay at the bank.

How to pay your PD7A (monthly payroll remittance):

First, we’ll log in to the account using our usual username and password. Then, we’ll click into payroll and RP-0001, and select “pay source deduction remittances.” It’s important to have the PD-7A form that we sent you at the end of the month handy when you get to this screen. Hope this helps!

You can follow the same steps as above and click on Generate a QR Code instead of online payment.

How to make a corporate tax instalment if you know what you want to pay:

First, you’ll need to log in to your account and click on Corporation Income Tax, then RC0001. If you know how much you want to pay, you can click on “View and Pay Account Balance”. Once you’ve confirmed the correct year and payment amount, you can proceed to pay. You have the option to make a one-time payment or schedule monthly installments. We recommend scheduling payments so you don’t forget about them. In the video example above, Teya will show you how to schedule six monthly payments of $1,000 each, starting in July and ending in December 2023, for a total of $6,000. We hope you find this helpful!

There is also an option in the Corporate tax section to “Calculate and pay instalments”. Follow the steps and it will walk you through calculating the required instalments based on your corporate tax owing from your previous fiscal year.

When you make a payment, your financial institution’s online banking app or website will display the date your payment was made. Payments are usually received by the CRA within 5 business days. To avoid fees and interest, please make sure you pay on time.