Do you have two jobs?

If the answer is yes, then you need to make sure your employer is deducting enough tax from each pay cheque to ensure you don’t end up owing taxes when you file your tax return.

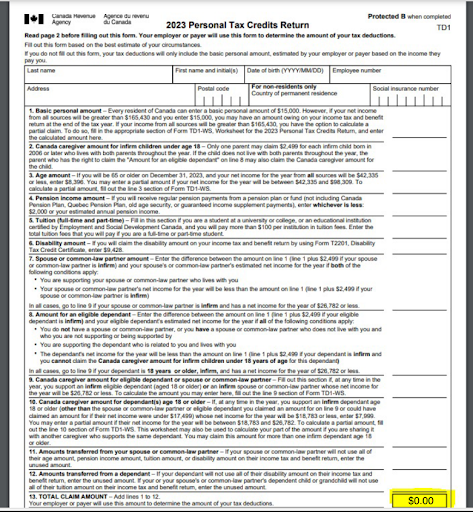

Usually, when you become an employee, you will be asked to fill out TD1 forms for Federal and Provincial taxes. You need to complete both of these forms with each employer.

If you fill both forms out in the standard way, you are asking your employer to apply the basic personal exemption to your paycheques (a non-refundable tax credit that can be claimed by all individuals to your annual income). This is fine if you only have one employer. The moment you start working for more than one company, you need to pay more attention to these forms as you can only claim the tax credit once.

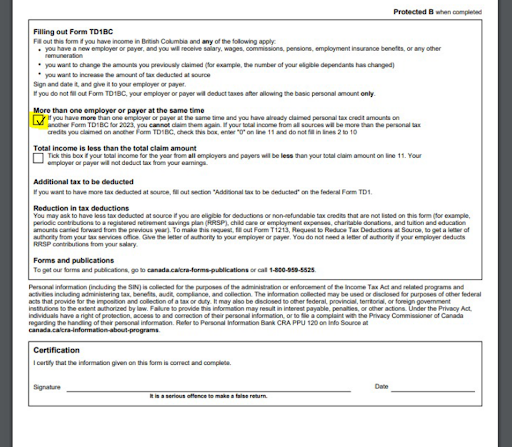

If you get the second job, you need to check off “More than one employer or payer at the same time” on this form and put zero for the total claim amount.

It’s not a difficult process but it is an essential one if you want to avoid a nasty surprise come tax time. Now that is sorted what are you waiting for? Get back to work! 🙂