Running a small business is an eternal learning curve of aha moments. Whether you’re filing an income tax return as a startup or exploring entrepreneurship for down the road, here’s one of the most popular questions that come up every year come tax time.

“Do I need to file two tax returns?”

Every year, many new small business owners who are NOT incorporated ask whether they need to file two tax returns: personal and business.

Before we jump into the answer let’s look at what is classified as business income.

Canada Revenue Agency (CRA) classifies business income as money you earn from the following:

- Profession

- Trade

- Manufacture or

- The undertaking of any kind, an adventure or concern in the nature of trade, or any other activity you carry on for profit and there is evidence to support that intention.

(So essentially any money you make that doesn’t come with a T4 at the end of the year)

NOTE: This income may be earned from a business you operate yourself as a sole proprietorship (SP) or with someone else as a partnership.

CRA Tip: You have to report all amounts of income that are required for calculating income for tax purposes. If you do not report all your income, you may be subject to a penalty of 10% of the amount of income that you did not report.

I Definitely Have Business Income. Do I Need To File Two Tax Returns?

The short answer is – NO! You just need to file ONE return. But… and there is always a BUT…There is more to the process than a simple personal tax return.

Additional Step

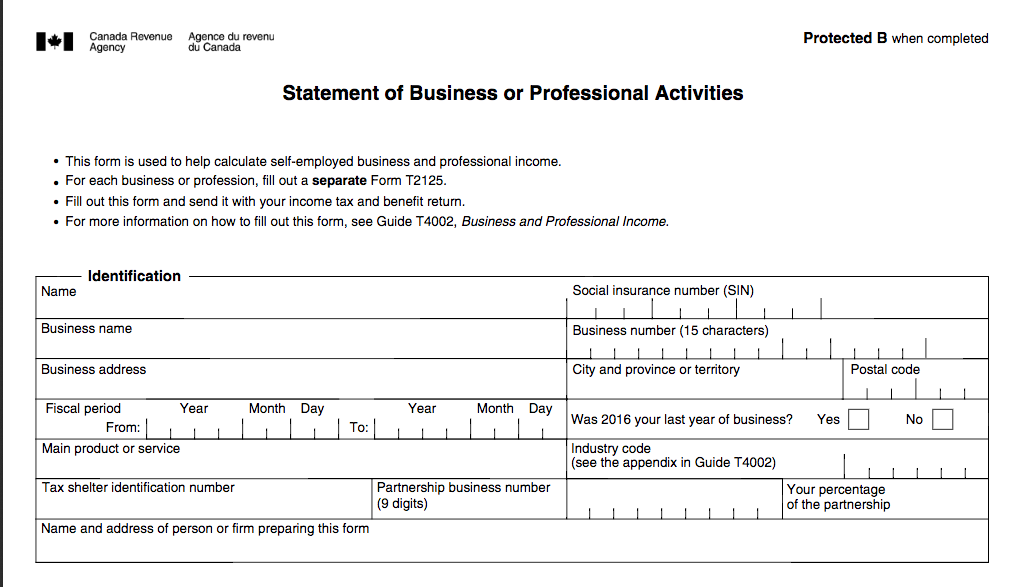

As a sole proprietor (SP), you need to report your business income on your personal tax return (AKA T1 General) by completing and attaching a Form T2125: Statement of Business or Professional Activities (see below).

Other Fun Facts You Should Know

While you only need to file ONE tax return, there are some tax benefits to being self-employed that you don’t get as an employed individual:

- Deadline

- While the deadline for individuals filing their 2017 personal income tax return is April 30, 2018, SPs get until June 15, 2018 to file their taxes. That is, if you or your spouse or common-law partner carried on a business in 2017. However, if you owe tax money that is due on April 30, so it’s best to get in early.

- One extra form to complete

- All your business tax deductions are reported on Form T2125, Statement of Business or Professional Activities (pictured above).

- Business tax deductions

- Business expenses: Deduct only the business expenses from business income Eg. Meals, Travel, Equipment, Office Supplies relevant to your business.

- Home Office Tax Deductions: In order to deduct expenses, the workspace must either be:

-

the place where the individual principally (more than 50% of the time) performs administration or employment duties,or

-

used on a regular and continuous basis, for meeting customers or other persons in the ordinary course of performing the office or employment duties.

-

You can deduct expenses that are required to run your home office. Eg: Utilities and maintenance costs. If you rent your home, you can deduct a portion of your monthly rent. You can deduct the cost of office expenses (eg: Pencils, stationery, paper clips, stamps, etc). You have to claim the maintenance and repairs related to business use of work space in your home as business-use-of-home expenses. Learn more here.

-

-

- Private Health Services Plan Premiums: You can deduct the Private Health Services Plan (PHSP) Premiums you pay to insure yourself, your spouse and/or any dependents. Click here for more info.

Can Homeroom Just File For Me?

Of course, individual and business tax returns are our specialty.

Check out our Business Tax Checklist to see what we need to complete your return.

Contact us here if you have any questions or concerns.

Happy 2018 tax season!